The maximum loan you can get must be 3 times your savings or 3 times your shares for a shares loan. However, there are cases where a member may not have the required savings to qualify for a loan.

A member can then decide to apply for a self-financing loan, with this loan, part of the loan is used as savings/shares so that the loan limit can be increased.

To create a self-financing loan, click self-financing loan on the navigation bar and enter the required prompts.

The remaining process is the same as highlighted in the previous section for loans.

You the loan calculator to visualize the loan schedule before you enter your loan.

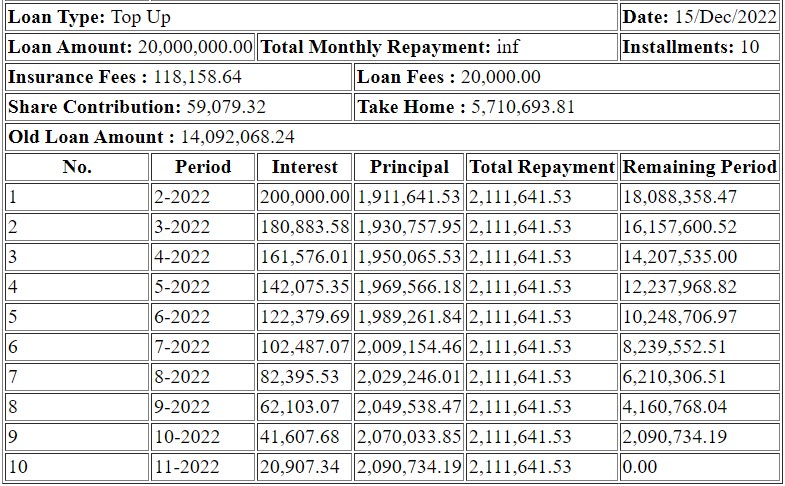

Below is a sample of a loan schedule with a member who has an outstanding loan of 14,092,068.24 and applied for a top-up of 20,000,000. Part of the top-up was used to cover the previous loan.